North American IP Camera Market Research Report – Segmented By Component ( Hardware , Services ) Product Type ( Fixed Cameras , Pan-Tilt-Zoom (PTZ) Cameras ) Connection Type ( Consolidated Systems Distributed Systems ) End-Use ( Commercial, Industrial ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North American IP Camera Market Size

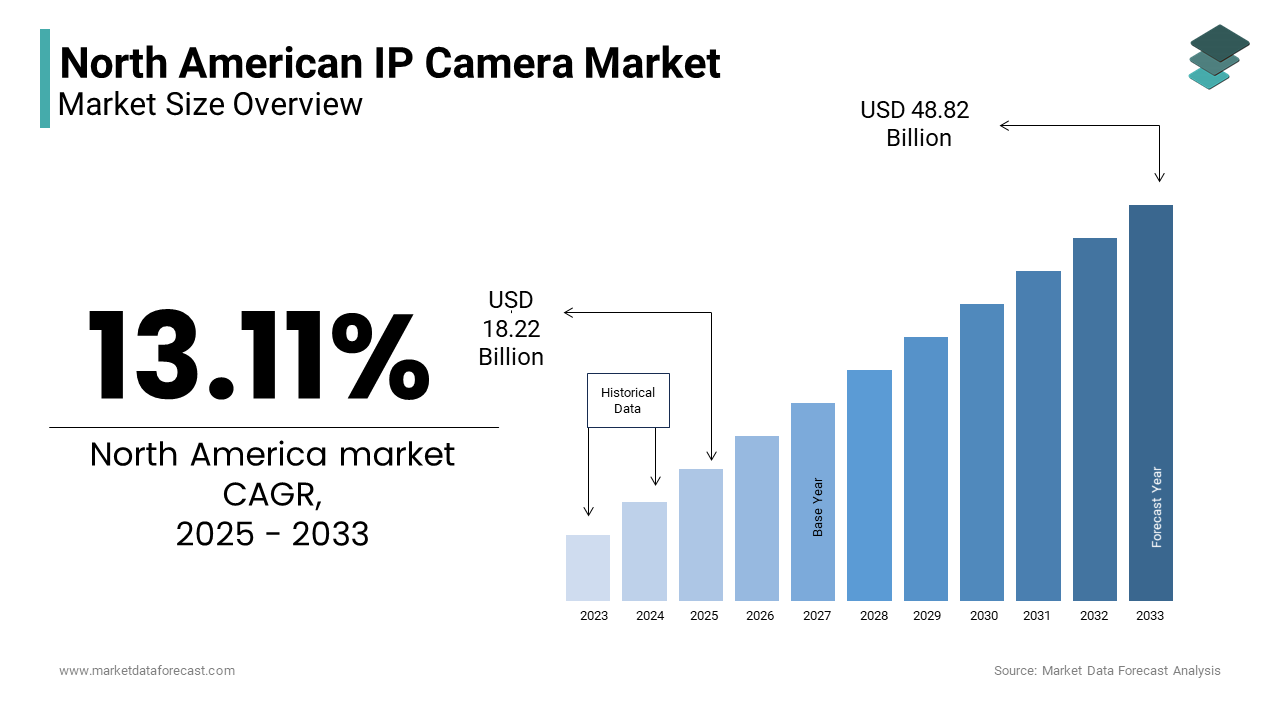

The North American IP Camera Market Size was valued at USD 16.11 billion in 2024. The North American IP Camera Market size is expected to have 13.11 % CAGR from 2025 to 2033 and be worth USD 48.82 billion by 2033 from USD 18.22 billion in 2025.

The North American IP camera market is experiencing robust growth. It is driven by the increasing demand for advanced surveillance solutions across various sectors. According to a study by the National Institute of Standards and Technology (NIST), the region accounts for over 40% of the global IP camera market, reflecting its leadership in adopting cutting-edge security technologies. Moreover, the rise in criminal activities and the need for enhanced public safety have further fueled this demand. As per the Federal Bureau of Investigation (FBI), property crimes alone cost the U.S. economy approximately $16 billion annually, underscoring the importance of reliable surveillance systems.

In addition to these, the proliferation of smart cities and IoT-enabled devices has accelerated the adoption of IP cameras. A report by Deloitte Insights stresses that over 75% of North American municipalities are investing in smart infrastructure, with IP cameras playing a pivotal role in traffic monitoring, crowd management, and disaster response. This convergence of security needs and technological advancements positions North America as a key driver of innovation in the IP camera market.

MARKET DRIVERS

Rising Demand for Smart Surveillance Systems

The increasing adoption of smart surveillance systems is a primary driver propelling the North American IP camera market. And, these capabilities are particularly valuable in urban areas, where smart city initiatives are gaining traction. For instance, as per the U.S. Department of Transportation, over 50% of metropolitan regions have implemented smart surveillance systems to enhance public safety and optimize resource allocation. Furthermore, the growing emphasis on remote monitoring has bolstered demand, with businesses leveraging cloud-based platforms to manage surveillance data.

Stringent Security Regulations

Stringent government regulations mandating enhanced security measures are another significant driver shaping the market landscape. As per the Security Industry Association (SIA), regulatory frameworks such as the Homeland Security Presidential Directive (HSPD-12) have compelled organizations to adopt advanced surveillance technologies. For example, the U.S. government has allocated over $7 billion annually to homeland security initiatives, with a significant portion dedicated to upgrading surveillance infrastructure. In extension of this, industries such as banking and healthcare are required to comply with stringent data protection laws, driving the adoption of IP cameras equipped with encryption and cybersecurity features. According to PwC, the financial sector alone accounts for nearly 30% of total IP camera installations in North America, reflecting the critical role of regulatory compliance in market growth.

MARKET RESTRAINTS

High Initial Deployment Costs

Among the primary restraints hindering the growth of the IP camera market is the substantial upfront investment required for deployment. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs), which often lack the resources to implement comprehensive surveillance solutions. As an additional point, retrofitting existing infrastructure with IP cameras adds to the overall expense. Findings by the National Institute of Building Sciences indicates that retrofitting costs can increase project budgets by up to 25%, deterring potential adopters and slowing market penetration. So, these factors collectively create barriers to entry for organizations seeking to upgrade their security systems.

Privacy Concerns and Data Security Risks

Privacy concerns and data security risks pose another significant challenge to the IP camera market. As per a study by Cybersecurity Ventures, cyberattacks targeting IoT devices including IP cameras, are expected to account for 25% of all breaches by 2025. The lack of standardized encryption protocols and vulnerabilities in firmware have made IP cameras a prime target for hackers. For instance, a report by Symantec revealed that over 50% of IoT devices used in commercial settings are susceptible to medium- or high-severity attacks. To augment this, public resistance to widespread surveillance has intensified, with advocacy groups raising concerns about potential misuse of footage. Consequently, these issues not only escalate operational risks but also increase compliance costs, impeding the market’s progress.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into IP cameras presents a transformative opportunity for the North American market. Moreover, these systems can identify anomalies, predict potential threats, and automate decision-making processes, making them invaluable for sectors such as retail and transportation. For instance, as per the Retail Industry Leaders Association (RILA), AI-enhanced surveillance systems have reduced theft-related losses by up to 40% in major retail chains. Besides, advancements in edge computing have enabled IP cameras to process data locally, reducing latency and bandwidth usage. So,this convergence of AI and surveillance technologies is poised to unlock new revenue streams and drive market expansion.

Expansion of Smart City Projects

The expansion of smart city projects offers another lucrative opportunity for the IP camera market. IP cameras play a pivotal role in these projects by enabling applications such as traffic management, environmental monitoring, and public safety. For example, as per the U.S. Department of Energy, cities like New York and Los Angeles have deployed thousands of IP cameras to monitor air quality and pedestrian flow, enhancing urban planning and resource allocation. As well as, the integration of 5G networks has further accelerated this trend, as it allows for seamless connectivity and high-definition video streaming. As a result, with governments prioritizing sustainable urban development, the demand for IP cameras is expected to surge and is creating significant growth prospects.

MARKET CHALLENGES

Interoperability Issues

Interoperability challenges represent a significant hurdle in the IP camera market. As per a study by the International Electrotechnical Commission (IEC), the lack of universal standards for communication protocols has led to compatibility issues between different brands and models. This fragmentation complicates system integration, particularly in large-scale deployments involving multiple vendors. For instance, a report by Gartner highlights that interoperability issues can increase installation times by up to 30%, while also escalating maintenance costs. To enhance this perspective, the absence of standardized interfaces hinders the seamless exchange of data between IP cameras and other IoT devices, limiting their functionality. Addressing these challenges requires collaborative efforts from industry stakeholders to establish unified standards, which remains a complex and time-consuming process.

Regulatory Compliance and Legal Constraints

Regulatory compliance and legal constraints pose another critical challenge to the IP camera market. As per the American Civil Liberties Union (ACLU), stringent privacy laws, such as the California Consumer Privacy Act (CCPA), impose strict guidelines on the collection and storage of surveillance footage. Non-compliance can result in hefty fines and reputational damage, deterring organizations from adopting IP cameras. Furthermore, legal disputes over the use of surveillance systems in public spaces have intensified, with courts ruling against unauthorized monitoring in certain jurisdictions. For example, a study by the Brookings Institution reveals that over 60% of municipalities face legal challenges related to surveillance practices. These regulatory bottlenecks not only increase operational complexity but also hinder market growth, necessitating innovative solutions to balance security and privacy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.11 % |

|

Segments Covered |

By Component, Product Type, Connection Type, End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Hangzhou Hikvision Digital Technology Co. Ltd.,Bosch Security Systems GmbH,Honeywell International Inc.,Johnson Controls. |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the North American IP camera market by capturing a substantial portionof the total market share in 2024. This dominance is attributed to the increasing demand for high-resolution cameras equipped with advanced features such as night vision, thermal imaging, and 4K resolution. Also, the proliferation of IoT devices has further propelled hardware adoption, with businesses prioritizing real-time monitoring and data collection. Based on the research by the Consumer Technology Association (CTA), the shipment of smart cameras in North America is expected to grow by 25% annually, driven by innovations in sensor technology and image processing. Additionally, the rising number of residential and commercial installations has solidified hardware’s position as the largest component segment.

The services segment is the fastest-growing component, with a projected CAGR of 22% from 2025 to 2033. This sudden rise is credited to the increasing reliance on managed services for system maintenance, data analytics, and cybersecurity. Organizations are outsourcing these functions to reduce operational costs and ensure compliance with regulatory standards. For instance, according to IBM, managed service providers (MSPs) have reported a 30% increase in demand for surveillance-related services over the past two years. Apart from these, the integration of cloud platforms has further accelerated this trend, enabling scalable and cost-effective solutions. With businesses prioritizing efficiency and risk mitigation, the services segment is poised to outpace hardware in terms of growth.

By Product Type Insights

The segment of fixed cameras constituted the biggest product type and held a market share of 54.1% in 2024. Popularity of this segment their affordability, ease of installation, and suitability for static surveillance applications. As per the National Institute of Justice (NIJ), fixed cameras are widely used in retail stores, offices, and residential complexes, where continuous monitoring of specific areas is required. The advent of high-definition lenses and AI-driven analytics has further enhanced their functionality, making them an attractive option for budget-conscious consumers. To augment this, the growing emphasis on perimeter security has bolstered demand, reinforcing fixed cameras’ dominance in the market.

The PTZ cameras segment is witnessing the swift development in this market and is believed to attain a CAGR of 18% during the forecast period. This growth is driven by their versatility and ability to cover large areas with minimal units. Industries such as transportation and logistics are increasingly adopting PTZ cameras for applications like traffic monitoring and warehouse management. As per the U.S. Department of Transportation, the deployment of PTZ cameras has reduced incident response times by up to 40%, showcasing their operational efficiency. Furthermore, advancements in motorized controls and zoom capabilities have expanded their use cases, positioning them as a key growth driver in the IP camera market.

By Connection Type Insights

The consolidated systems segment prevailed in the North American IP camera market by accounting for 68.1% of the total share in 2024. Their leadership is underpinned by their centralized architecture, which simplifies data management and reduces operational costs. According to the National Institute of Standards and Technology (NIST), consolidated systems are particularly favored in small- to medium-sized enterprises (SMEs), where scalability and ease of integration are critical. The adoption of cloud-based platforms has further enhanced their appeal, enabling real-time data access and remote monitoring. In support of this, their compatibility with legacy systems has solidified their position as the preferred choice for organizations seeking cost-effective surveillance solutions.

The distributed systems segment is the rapidly expanding category, with a calculated CAGR of 20.1%. This development is associated with their potential to support large-scale deployments across geographically dispersed locations. Also, industries such as manufacturing and logistics are increasingly adopting distributed systems to monitor multiple facilities simultaneously. For instance, as per the Manufacturing Institute, distributed systems have improved operational visibility by up to 35%, enabling better decision-making and resource allocation. Moreover, the integration of 5G networks has further accelerated this trend, as it ensures low latency and high bandwidth connectivity. So, with enterprises prioritizing scalability and flexibility, distributed systems are poised to emerge as a key growth driver.

By End-Use Insights

The commercial segment was at the forefront of the North American IP camera market by capturing 50.3% of the total share in 2024. This control over the market is due to the increasing demand for surveillance systems in retail stores, office complexes, and hospitality venues. According to the National Retail Federation (NRF), IP cameras have reduced theft-related losses by up to 30% in the retail sector, underscoring their value proposition. Additionally, the growing emphasis on workplace safety and compliance with regulatory standards has further bolstered adoption. The integration of AI-driven analytics has expanded their use cases, solidifying the commercial segment’s leadership in the market.

The industrial segment is the fastest-growing end-use category, with a CAGR of 25%. This is driven by the increasing adoption of IP cameras for applications such as asset tracking, production monitoring, and worker safety. As per the Manufacturing Institute, the deployment of IP cameras in industrial settings has improved operational efficiency by up to 40%, enabling proactive maintenance and risk mitigation. The integration of IoT and edge computing has further accelerated this trend, as it allows for real-time data processing and decision-making. With industries prioritizing automation and digital transformation, the industrial segment is poised to outpace other end-use categories in terms of growth.

COUNTRY LEVEL ANALYSIS

The United States in 2024 dominated the North America smart TV market, holding a 78.2% share. This influence over the landscape can be caused by high consumer spending on electronics, driven by widespread internet penetration and urbanization. According to the Federal Communications Commission, over 90% of U.S. households had access to high-speed internet, enabling seamless streaming services like Netflix and Hulu. Moreover, the Consumer Technology Association noted that smart TVs accounted for 65% of total TV sales in 2024, reflecting their critical role in modern entertainment. Innovations in AI-driven features further strengthend the U.S.'s dominance, making it a pivotal driver of regional growth.

Canada is expected to be the fastest-growing market, with a CAGR of 12.3% from 2025 to 2033. This growth can be fueled by increasing urbanization, rising disposable incomes, and government initiatives promoting digital transformation. For instance, the Canadian Radio-television and Telecommunications Commission predicts a 40% increase in smart home adoption by 2030, creating a conducive environment for smart TV integration. Advancements in 8K resolution and voice-controlled interfaces will amplify demand, particularly among tech-savvy millennials. Partnerships between manufacturers and content providers will further enhance accessibility. Canada’s focus on innovation positions it as a transformative force in the North America smart TV market.

Mexico, though smaller in scale, is anticipated to witness steady growth. Rising middle-class populations and increasing awareness of digital technologies are expected to drive this trend. Government-backed campaigns promoting connectivity in rural areas will further accelerate adoption. However, challenges such as limited internet access persist, with only 60% of rural households connected, according to the International Telecommunication Union. Despite these constraints, Mexico’s strategic positioning as a burgeoning market offers significant potential for long-term growth, ensuring its contribution to regional expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North American IP Camera Market are Hangzhou Hikvision Digital Technology Co. Ltd.,Bosch Security Systems GmbH,Honeywell International Inc.,Johnson Controls,Panasonic Corporation,Samsung Electronics Co. Ltd.,Sony Corporation,Schneider Electric SE,Avigilon Corporation,Arecont Vision Costar LLC.,Vivotek Inc.,Stealth Monitoring.

The North American vascular stents market is characterized by intense competition, with key players vying for market leadership through innovation and strategic initiatives. Companies are focusing on developing next-generation stents, such as bioresorbable and drug-eluting variants, to address unmet clinical needs. The presence of established players like Abbott Laboratories and Boston Scientific Corporation has raised the bar for product quality and performance. Additionally, emerging firms are entering the market with cost-effective solutions, intensifying rivalry. Regulatory approvals and patent protections serve as key differentiators, while partnerships with healthcare providers enhance market penetration. This competitive landscape underscores the importance of continuous innovation and strategic foresight.

Top Players in the Market

Axis Communications

Axis Communications is a global leader in the IP camera market, renowned for its innovative network video solutions. The company’s market position is fortified by its commitment to delivering high-performance cameras equipped with advanced analytics and AI-driven features. Axis’s strengths lie in its extensive R&D capabilities and strategic collaborations with technology partners, enabling it to cater to diverse industries such as retail, transportation, and healthcare. Its focus on sustainability and energy-efficient designs further enhances its appeal, solidifying its reputation as a pioneer in the surveillance industry.

Hikvision

Hikvision is a key contributor to the global IP camera ecosystem, offering a comprehensive portfolio of products tailored to meet varying end-user needs. The company’s prominence is underscored by its expertise in developing cost-effective solutions without compromising on quality. Hikvision’s strengths include its robust distribution network and emphasis on integrating cutting-edge technologies such as thermal imaging and deep learning. Its ability to deliver scalable solutions for both small-scale deployments and large-scale projects has positioned it as a preferred choice for enterprises seeking reliable surveillance systems.

Bosch Security Systems

Bosch Security Systems specializes in providing premium IP cameras designed for mission-critical applications. The company’s market prominence is bolstered by its focus on delivering secure and interoperable solutions that adhere to stringent regulatory standards. Bosch’s strengths lie in its emphasis on cybersecurity and data protection, ensuring compliance with global privacy laws. Its customer-centric approach and commitment to innovation have enabled it to establish a strong foothold in sectors such as banking, government, and industrial facilities, reinforcing its leadership in the market.

Top strategies used by the key market participants

Key players in the North American IP camera market are leveraging strategies such as product differentiation, strategic partnerships, and geographic expansion to strengthen their positions. For instance, companies are investing heavily in R&D to develop AI-powered cameras capable of real-time analytics, enhancing their competitive edge. Strategic collaborations with cloud service providers and IoT platforms are also prevalent, enabling players to offer integrated solutions that cater to evolving customer needs. Additionally, expanding into untapped markets, such as smart cities and industrial automation, has allowed companies to diversify their revenue streams. These strategies collectively drive innovation and ensure sustained market growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Axis Communications launched its AI-Powered Network Camera Series, designed to enhance real-time analytics and predictive capabilities. This move is expected to solidify its leadership in the IP camera market.

- In June 2024, Hikvision announced a partnership with AWS to integrate its cameras with cloud-based IoT platforms, enabling scalable surveillance solutions.

- In August 2024, Bosch Security Systems unveiled its Enhanced Cybersecurity Framework, aimed at addressing vulnerabilities in IP camera systems.

- In October 2024, Axis Communications acquired a startup specializing in edge computing technologies to bolster its AI-driven analytics offerings.

- In December 2024, Hikvision introduced its Thermal Imaging Camera Line, targeting industrial and government applications requiring high-precision monitoring.

MARKET SEGMENTATION

This research report on the north american ip camera market has been segmented and sub-segmented into the following.

By Component

- Hardware

- Services

By Product Type

- Fixed Cameras

- Pan-Tilt-Zoom (PTZ) Cameras

By Connection Type

- Consolidated Systems

- Distributed Systems

By End-Use

- Commercial

- Industrial

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What factors are driving the growth of IP camera adoption in North America?

Key drivers include rising concerns over public and private security, adoption of smart city projects, increased government investments, and advancements in AI-powered surveillance systems.

What industries are the largest consumers of IP camera systems in North America?

Major sectors include government & law enforcement, commercial retail, transportation, banking, education, and residential segments.

What challenges does the IP camera market face in North America?

Challenges include cybersecurity concerns, high initial installation costs, data privacy regulations, and interoperability issues across different systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]